Virginia S. Gilstrap, reporter/ managing editor

The overall property values in DeWitt County increased by 10% this year, so the county tax rate will likely decrease by about 10%, County Judge Daryl Fowler said at a special meeting of the Commissioners Court on July 31.

“We’re seeing this year for the first time where property owners, mineral-rights owners, etc. have had their properties re-appraised at 50% increases sometimes,” Fowler said.

The temporary “circuit breaker” law, passed by the state legislature in 2023, sets a limit of 20% increase in property value.

At the special meeting, the commissioners met to receive the 2024 Certified Tax Appraised Values and the 2025 Anticipated Tax Collection Rate as well as schedule public hearings on county taxes and budget.

They also approved an addendum for a request

See for proposals on Hazard Mitigation Plan Development and Grant Management Services.

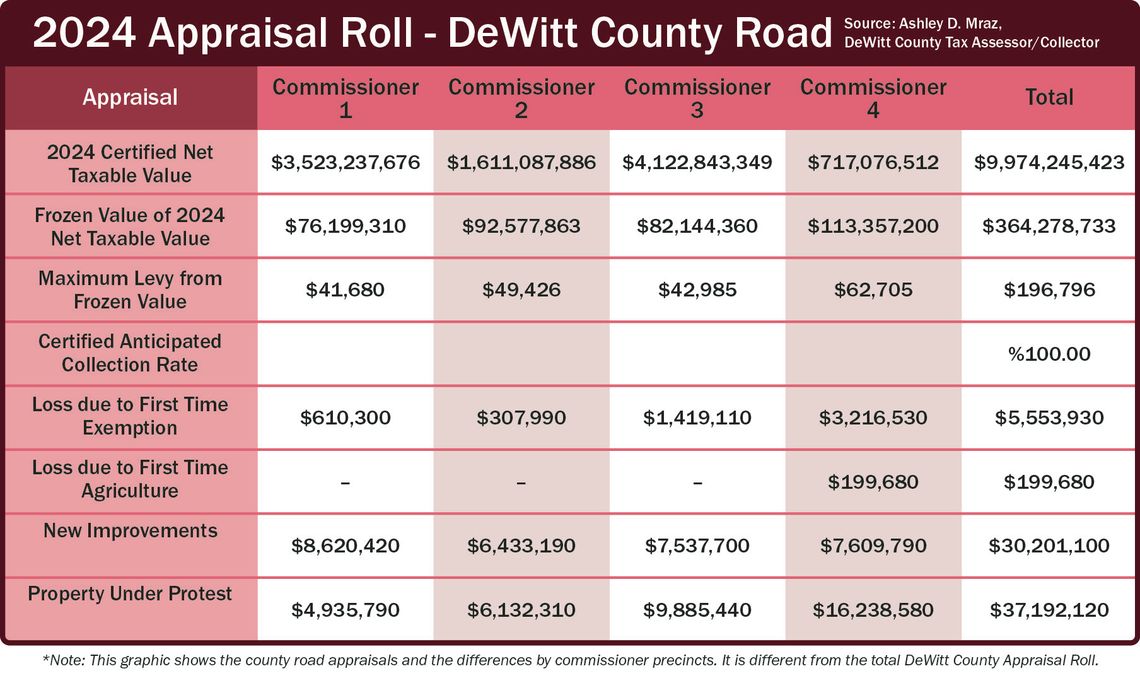

County Tax Assessor/ Collector Ashley Mraz shared her breakdowns of the DeWitt County Appraisal Roll and the DeWitt County Road Appraisal Roll to the commissioners. She reported a certified net taxable value of $9,988,006,018 for DeWitt County.

“Out of that amount $371,830,083 are frozen due to over 65 or disability,” Mraz said. “Property still under protest is $37,192,120.” She said the anticipated collection rate was 100%.

The County Road appraisal breaks down the tax values by precinct. Judge Fowler outlined the disparity between precincts to bring up past options for revenue distribution.

He pointed out that Precinct 4, which is in the southern part of the county and represented by Brian Carson, has the lowest net tax values but the highest frozen values. It also has the highest amount under protest.

The precinct may not have the oil field revenue that others do, Fowler said, but it has gravel and other assets that support the rest of the county.

“Previous courts have made allowances for it (disparity),” Fowler said, indicating the distribution was 30/30 and 20/20, with the lower tax revenue precincts receiving the extra 10%.

For the long term revenue outlook, Judge Fowler pointed out that aging citizens means an increase in frozen dollars in tax values. “The EDC, and others, need to get young folks back here,” he said.

He said Eagle Ford oil revenue will dry up one day and the county needs to be ready for it.

The court set a public hearing on the 2024 proposed tax rate for Monday, Aug. 12 at 9 a.m. On Monday, Aug. 26, a public hearing is set on the 2025 Proposed De-Witt County Budget and the Proposed 2024 Tax Rate.